BMO Online Banking: New App Features & Partnerships

1 year ago

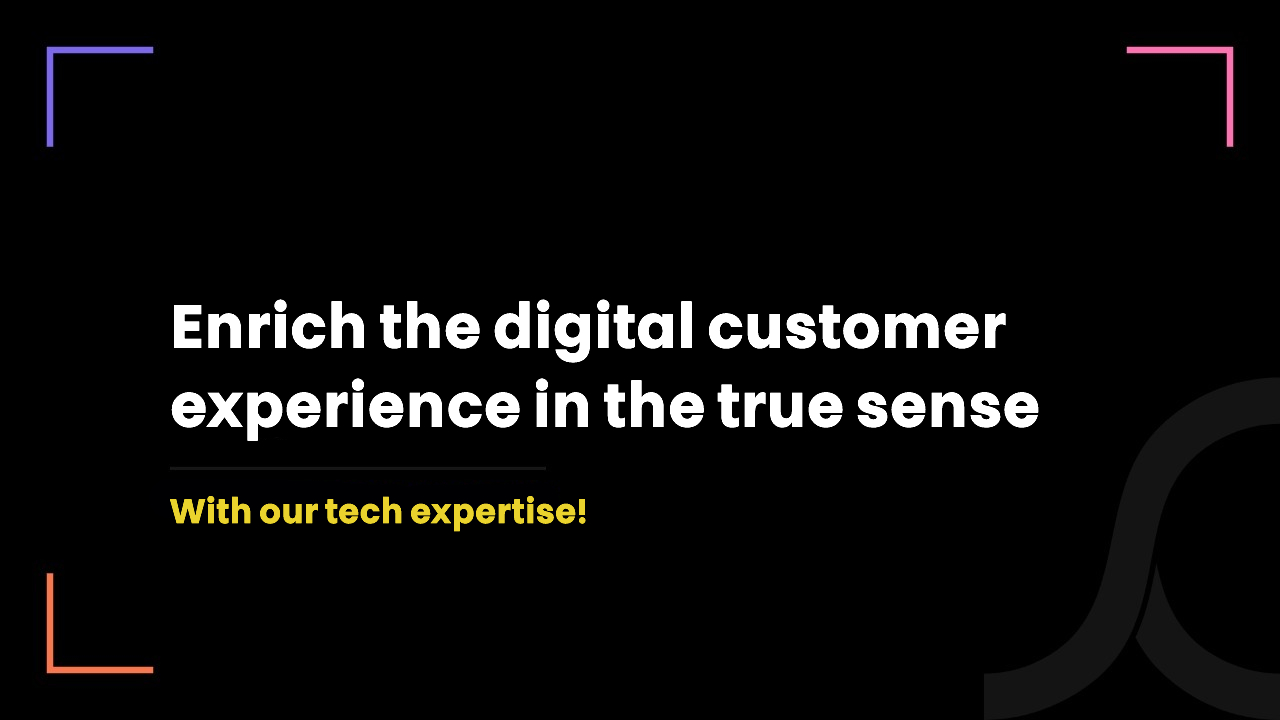

While all tech enthusiasts and individuals were busy discussing how safe is the newly launched COVID Alert app, North America’s 8th largest bank by assets - Bank of Montreal (BMO) - announced a strategic partnership with Google to roll out mobile-first bank accounts. [NewsWire]

The new digital chequing accounts can be managed through Google Pay and it will be available to U.S customers. This partnership will surely take the BMO online banking app to the next level.

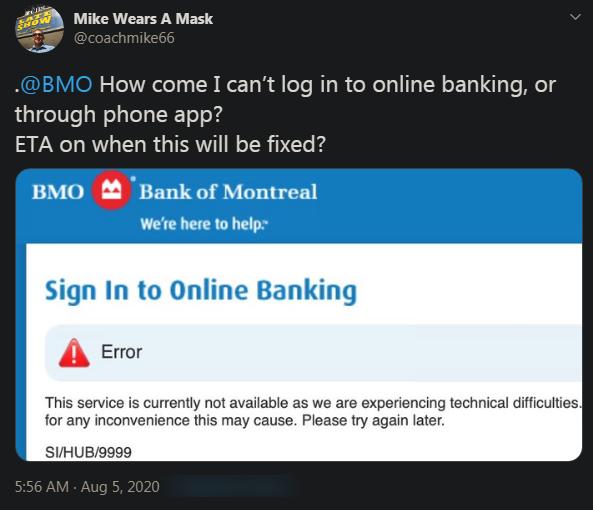

Meanwhile, many users complained about service unavailability!

You Must be Wondering Why a Bank Would Tie-Up with Google!

The Business Point of View:

The banking infrastructure - which has evolved greatly since the launch of the first bank in 1624 - recently started struggling to cope up with the modern banking movement - FinTech.

After the great recession of 2009 when the global economy demanded a modern and sustainable banking infrastructure, FinTech startups popped up.

FinTech startups are branchless banks leveraging technologies to easily address people’s financial needs.

It is the greatest threat to legacy banking infrastructure.

Collaboration or competition was the only choice banks had. And they chose collaboration!

Bank of Montreal promotes the same approach - partnering with FinTech companies to maximize the benefits of FinTech company’s technologies and the bank's large customer base & reputation.

The Technical Point of View:

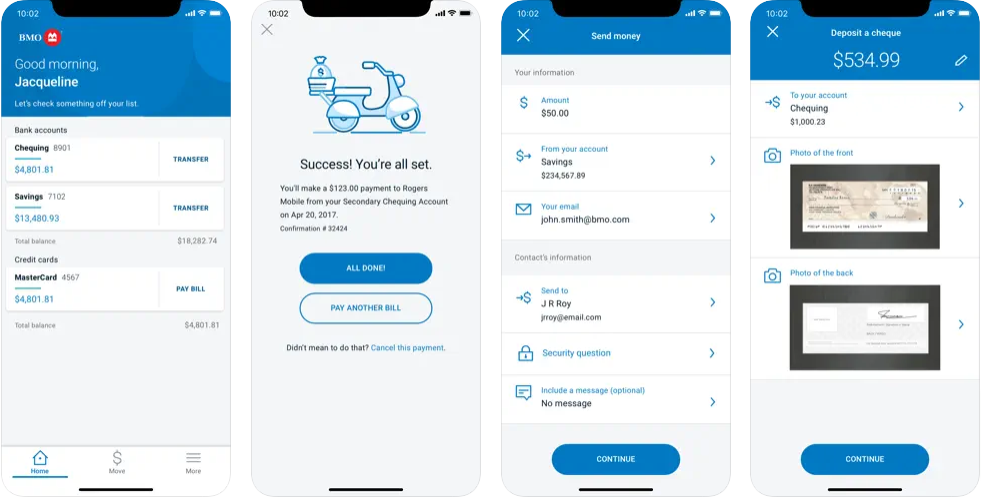

Bank of Montreal already supports BMO online banking with the BMO app.

However, to accelerate growth through customer-centric innovation, a brick-and-mortar bank would require not only an app but an app with remarkable user experience, financial insights, and budgeting tools.

Google Pay is the most advanced FinTech app.

By integrating it with the banking infrastructure of BMO mobile banking, the bank will be able to enable a new digital banking experience specifically designed for the new generation of customers.

BMO adds Up the ‘Same Day Grace’ Features to Help Customers in Managing Their Accounts

The Same Day Grace feature is a helping hand to Canadians to avoid the mess of missing payments and incurring fees by notifying them when their account balance deepens below zero.

It provides customers with a call-to-action to top up their everyday bank account and return their bank balance to the positive by noon that day.

This way, customers can avoid the hassle of the NSF (Non-sufficient Funds) fee.

The Importance of the ‘Same Day Grace’ Feature

The time is difficult.

Rising interest rates, high inflation, unemployment, and housing affordability are the major challenges right now in Canada.

The BMO Real Financial Progress Index recently uncovered that “The fear of the unknown (47 percent) and concerns about their overall financial situation (39 percent) are the top two primary aspects of financial anxiety amongst Canadians”.

Canadians have hope that their banks will give a helping hand against the unexpected crisis.

The same Day Grace feature gives peace of mind to the customers in this tough economic situation.

A ‘Pre-authorized Payment Manager’ Feature Decoding the Real-World Concerns of Customers Having Credit Cards

BMO recently added a Pre-authorized payment manager feature in order to decode the customers' credit card concerns such as,

- Issues with cancelling subscriptions

- Forgetting about the subscription cancellation

- The hassle of tracking monthly charges

The feature offers a complete view of past and future pre-authorized payments that contain subscriptions attached to a BMO credit card.

As a result, customers can track and manage their spent money without any hassle.

Just in Case, You are Interested in Knowing the FinTech App Design Philosophy.

Here are the 3 best examples of the FinTech app UI which always inspire our UI/UX designers who aim to motivate users to use the app as suggested in B. J. Fogg’s Behavior Model.

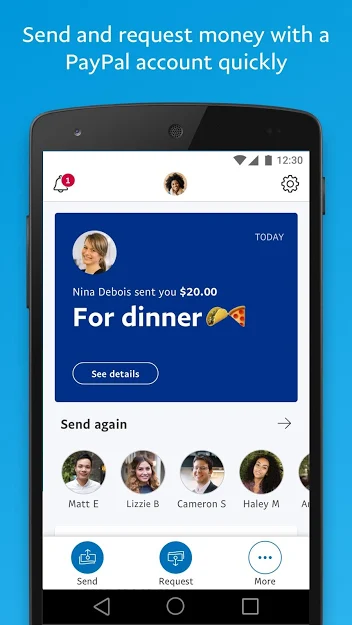

1. PayPal

A well-organized app home screen with the right fonts, clear information, and the simplest menu.

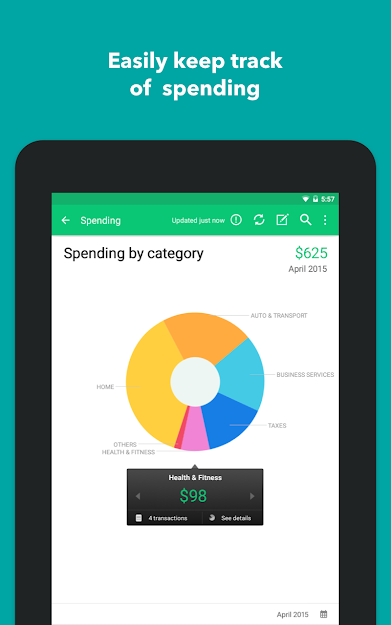

2. Mint

Making ‘budgeting’ fun and easy with precisely selected color palettes.

3. Robinhood

A trading app showing information in graphical ways to speed up user understanding and decisions.

BMO Online Banking will Make the Most of Google Pay’s Technologies. So, You Might Be Worried about the Technologies Your FinTech App Should Work on.

Technology is the driving factor.

It decides the way a FinTech app solves customer challenges with integrated features.

For instance, the budgeting feature working on AI technology works faster and more accurately and makes decisions automatically by utilizing intelligence to reduce user efforts by 80%.

The following are the top 4 FinTech technologies our team has mastered.

- Artificial Intelligence and Machine Learning

- Big Data and Data Analytics

- Robotic Process Automation

- Blockchain

Do You Hate Technical Things About FinTech Apps? You Should At Least Know About Banking APIs.

You must already know that a FinTech app can process payments from multiple sources or banks. Meaning, there must be some sort of connection between the app and the bank.

Banking APIs are useful to achieve this connection. It enables secure communication between the app and the bank.

A few use cases of banking APIs in FinTech apps:

- Price Comparison

- Peer-to-Peer Currency Exchange or Lending

- Investment Management

- Payment Processing

- Bolstered Account and Identity Fraud Protection

Here, you should be aware of the fact that improper API integration leads to errors and unfortunately, an error costs more when it comes to banking, regardless of online or offline!

We have gained the expertise to integrate top banking APIs into FinTech apps with the highest-ever success rate.

Such expertise draws a line between expert developers and noob developers!

We Lighten the Burden of Our Clients with Our Tech, Business, and Compliance Expertise!

We have been performing IT projects since 2015.

From app development and integration to RPA and AI & ML, we hold ultimate expertise in addressing the tech, business and compliance needs.

To do so, we have a 50+ army of dedicated and experienced IT professionals that include – UI/UX designers, app and web developers, integration specialists, business analysts, compliance specialists, AI & ML experts and RPA professionals.

For us, development is not only about doing coding all the time.

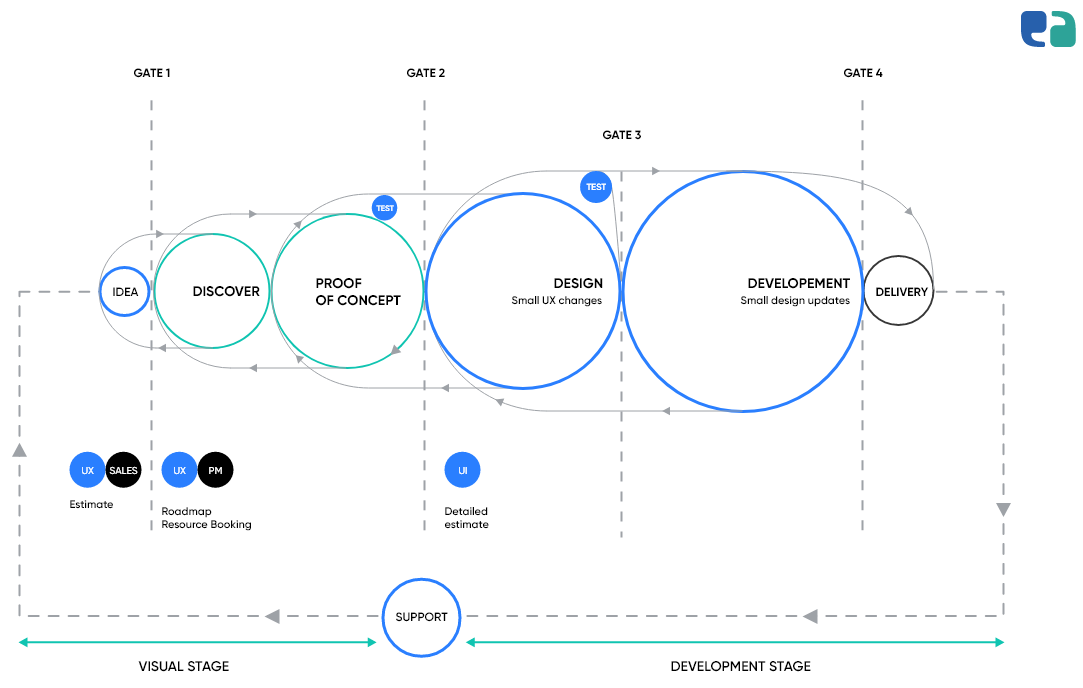

It means, we only do coding 20%, and the rest 80% includes – discovery, documentation, workflows, UI/UX, QA, compliance audit, pilot and launch.

In case you are wondering, here is how we deliver robust and outcome-driven tech solutions for startups, organizations and enterprises.