Health Insurance Management Platform: Features, Examples & Automation

9 months ago

Managing insurance in the healthcare system is more complicated than ever.

30% Canadians are still without adequate life or health insurance, according to the CIA, creating a big gap in coverage.

This gap is an opportunity for healthcare tech companies to develop smarter solutions to meet the demand.

The healthcare insurance market is booming and expected to hit $4.15 trillion by 2026.

Rising healthcare costs and the growing need for insurance are fueling this growth.

To address this, the industry is moving towards automated, all-in-one platforms like SimplyInsured.

These platforms replace outdated systems, streamline processes, and improve the user experience—exactly what’s needed in today’s health insurance landscape.

SimplyInsured: Simplifying Health Insurance for Small Businesses

SimplyInsured is an online platform that makes health insurance easy for small businesses.

It helps small business owners compare and buy medical, dental, and vision insurance plans.

In fact, it covers over 95% of the U.S. population.

The mission of SimplyInsured is to remove the confusion and worries about health insurance.

They want to make it simple and accessible for small businesses.

Founded in 2012, SimplyInsured is changing a $20 billion industry with their fully online platform.

This platform allows small businesses to provide health benefits quickly and easily.

How SimplyInsured Works

SimplyInsured provides a seamless way for small businesses to purchase and manage health insurance for their employees through their easy-to-use online platform. Here’s how they make it simple:

- Instant Quotes: Small business owners can get free, customized quotes from multiple plans in just a few seconds.

- 100% Online Application: The entire application process is done online in under 10 minutes, saving time and hassle.

- Automated Payroll Deductions: Their platform integrates with popular payroll systems, automating employee deductions and company contributions.

- 1-Click Renewals: Renewing plans is effortless with just a click, making it convenient to maintain coverage.

- Dedicated Support: SimplyInsured offers expert help through licensed insurance agents and claims specialists, ensuring businesses always have the guidance they need.

- Wide Selection of Plans: Businesses can choose from hundreds of plans provided by multiple carriers, ensuring they find the right fit.

SimplyInsured’s mission is to remove the confusion and fear from health insurance, providing small businesses with a simple, effective solution to protect their employees and their finances.

Opportunity in the Growing U.S. Individual Health Insurance Market

The U.S. individual health insurance market is a significant area of growth, valued at $1.60 trillion in 2022.

It's projected to expand at a rate of 6.08% annually from 2023 to 2030, reflecting a rising demand for health insurance solutions.

More insurance companies are entering the market, bringing fresh products and options for consumers.

In 2021 alone, around 30 new insurers began offering plans across 20 states, according to a report by KFF.

This influx of new players is helping to make health insurance more accessible, catering to the needs of individuals seeking coverage.

For those looking to build health insurance management platforms, understanding this dynamic landscape is crucial.

The growth and accessibility of insurance market highlight the opportunities for innovative health insurance softwares to simplify the purchasing process for consumers.

3 Essential Features to Build a Successful Health Insurance Management Platform

To create a truly effective healthcare insurance solution, it's crucial to incorporate a range of essential features. Here are some key components to consider:

1. Easy Enrollment Process

- Simple and intuitive signup process for all ages and skill levels.

- Clear, concise information on plans, including coverage, premiums, and deductibles.

- Data analytics to recommend plans that fit individual needs and budgets.

2. Streamlined Claim Management

- Direct claim filing through the platform to eliminate paperwork.

- Regular updates on claim progress for users.

- Automated workflows to speed up the claims process.

3. Personalized Recommendations

- Use user data for personalized recommendations on plans, providers, and treatments.

- Apply AI to analyze data and provide tailored advice.

- Conduct regular health assessments to identify risks and suggest suitable coverage.

If You Want to Build a Insurance Management Software Like SimplyInsured, Consider These 3 Key Integration Features

1. Payroll Integrations

- Automated Payroll Deductions: Enable automatic deductions of employee health insurance premiums from paychecks. This reduces the administrative burden on HR.

- Integration with Popular Payroll Platforms: Ensure seamless connections with widely used payroll systems like ADP, Paychex, Gusto, and QuickBooks Payroll.

2. HR Integrations

- API Integrations: Offer APIs that allow integration with existing HR systems, such as HRIS or ATS. This feature automates employee enrollment and benefits management, enhancing efficiency.

- Single Sign-On (SSO): Implement SSO so employees can access their accounts using existing HR system credentials.

3. Additional Integrations

- Time and Attendance Systems: Integrate with time and attendance systems to ensure accurate calculation of employee benefits based on hours worked.

- Benefits Administration Platforms: Connect with current benefits administration platforms to provide a comprehensive overview of employees’ benefits.

By incorporating these integration features into your healthcare insurance tech platform, you can save time, reduce errors, and enhance the overall experience for both employees and employers.

The Power Trio: App, Chatbot, and Automation for Your InsurTech Platform

To create a successful health insurance management platform, you need to leverage the latest technology.

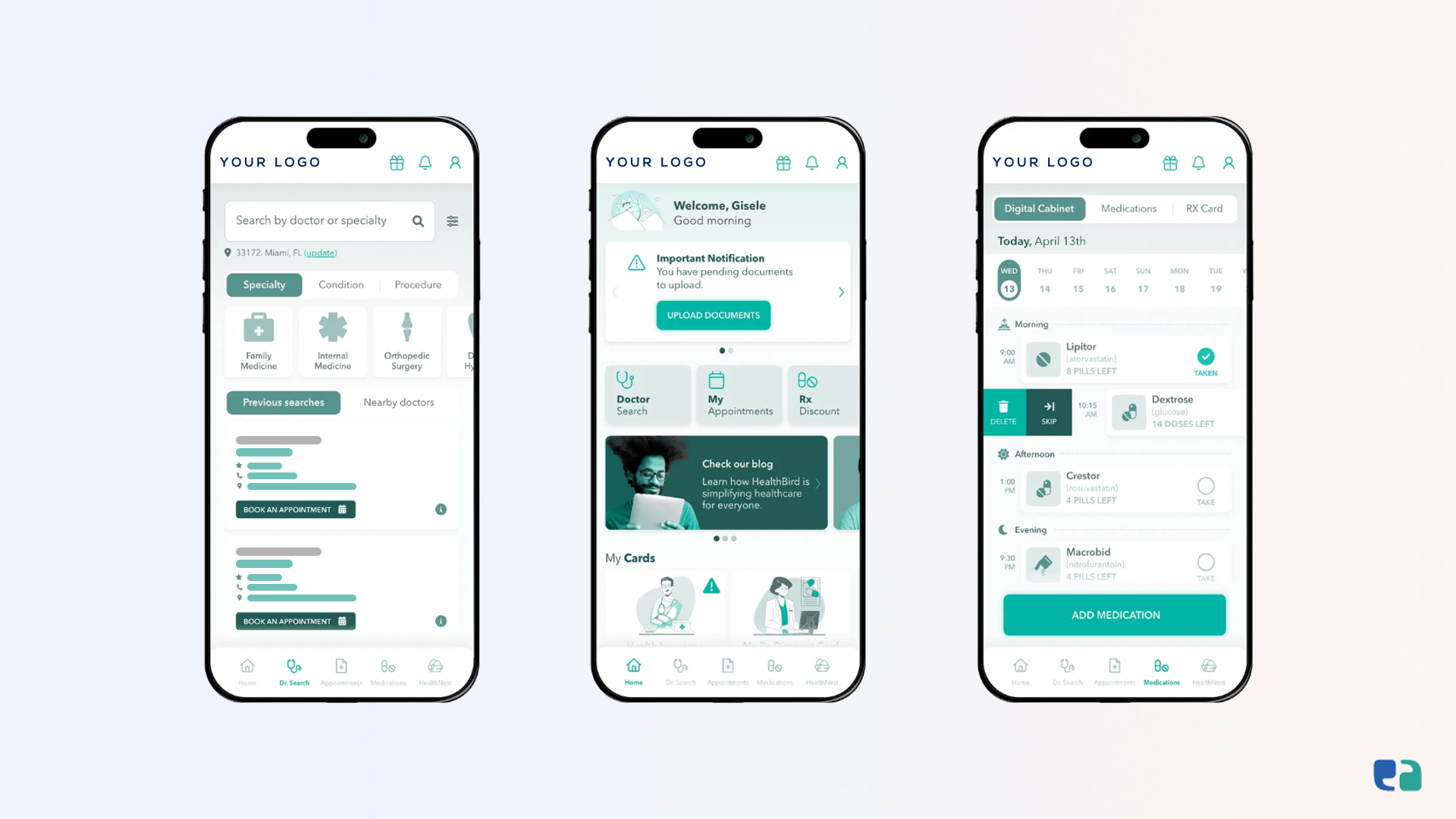

1. Mobile App

A user-friendly app is vital for simplifying the enrollment process and managing claims seamlessly.

It should offer clear navigation and easy access to information, ensuring users can find what they need without hassle.

2. Chatbot

Integrating a chatbot can revolutionize customer interactions. This software program simulates human conversations, providing 24/7 support without the need for human agents.

It quickly understands customer queries and delivers personalized responses in seconds.

By using a chatbot, you can significantly improve customer experience while reducing operational costs.

3. Robotic Process Automation (RPA)

Implementing RPA can transform your back-office operations. It automates tedious tasks like claims processing, invoicing, policy updates, cancellations, and data entry.

This not only boosts accuracy but also enhances productivity by freeing up your employees to focus on more strategic tasks.

We recently developed a health insurance app for our client. Check out the screenshots of it!